Abstract.

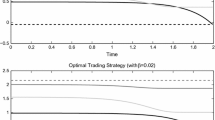

We investigate some portfolio problems that consist of maximizing expected terminal wealth under the constraint of an upper bound for the risk, where we measure risk by the variance, but also by the Capital-at-Risk (CaR). The solution of the mean-variance problem has the same structure for any price process which follows an exponential Lévy process. The CaR involves a quantile of the corresponding wealth process of the portfolio. We derive a weak limit law for its approximation by a simpler Lévy process, often the sum of a drift term, a Brownian motion and a compound Poisson process. Certain relations between a Lévy process and its stochastic exponential are investigated.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Received: January 2003

Mathematics Subject Classification:

Primary: 60F05, 60G51, 60H30, 91B28; secondary: 60E07, 91B70

JEL Classification:

C22, G11, D81

We would like to thank Jan Kallsen and Ralf Korn for discussions and valuable remarks on a previous version of our paper. The second author would like to thank the participants of the Conference on Lévy Processes at Aarhus University in January 2002 for stimulating remarks. In particular, a discussion with Jan Rosinski on gamma processes has provided more insight into the approximation of the variance gamma model.

Rights and permissions

About this article

Cite this article

Emmer, S., Klüppelberg, C. Optimal portfolios when stock prices follow an exponential Lévy process. Finance and Stochastics 8, 17–44 (2004). https://doi.org/10.1007/s00780-003-0105-4

Issue Date:

DOI: https://doi.org/10.1007/s00780-003-0105-4