Abstract

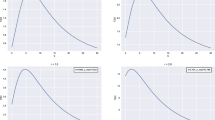

In this paper, we consider the dividend problem in a two-state Markov-modulated dual risk model, in which the gain arrivals, gain sizes and expenses are influenced by a Markov process. A system of integro-differential equations for the expected value of the discounted dividends until ruin is derived. In the case of exponential gain sizes, the equations are solved and the best barrier is obtained via numerical example. Finally, using numerical example, we compare the best barrier and the expected discounted dividends in the two-state Markov-modulated dual risk model with those in an associated averaged compound Poisson risk model. Numerical results suggest that one could use the results of the associated averaged compound Poisson risk model to approximate those for the two-state Markov-modulated dual risk model.

Similar content being viewed by others

References

Avanzi, B., Gerber, H.U., Shiu, E.S.W. Optimal dividends in the dual model. Insurance: Mathematics and Economics, 41(1): 111–123 (2007)

Cheung, E.C.K., Drekic, S. Dividend Moments in the Dual Model: Exact and Approximate Approaches. ASTIN Bulletin, 38(2): 399–422 (2008)

Gerber, H.U., Smith, N. Optimal dividends with incomplete information in the dual model. Insurance: Mathematics and Economics, 42: 243–254 (2008)

Avanzi, B., Gerber, H.U. Optimal dividends in the dual model with diffusion. ASTIN Bulletin, 38(2): 653–667 (2008)

Ng, A.C.Y. On a dual model with a dividend threshold. Insurance: Mathematics and Economics, 44: 315–324 (2009)

Asmussen, S. Risk theory in a Markovian environment. Scandinavian Actuarial Journal, 2: 69–100 (1989)

Reinhard, J.M. On a class of Semi-Markov risk models obtained as classical risk models in a Markovian environment. Austin Bulletin, 14: 23–43 (1984)

Reinhard, J.M., Snoussi, M. On the distribution of the surplus prior to ruin in a discrete Semi-Markov risk model. Austin Bulletin, 31: 255–273 (2001)

Bäuerle, N. Some results about the expected ruin time in Markov-modulated risk models. Insurance: Mathematics and Economics, 18: 119–127 (1996)

Schmidli, H. Estimation of the Lundberg coefficient for a Markov modulated risk model. Scandinavian Actuarial Journal, 1: 48–57 (1997)

Snoussi, M. The severity of ruin in Markov-modulated risk models. Schweiz. Aktuarver. Mitt., 1: 31–43 (2002)

Lu, Y., Li, S. On the Probability of Ruin in a Markov-modulated Risk Model. Insurance: Mathematics and Economics, 37(3): 522–532 (2005)

Li, S., Lu, Y. Moments of the dividend payments and related problems in a Markov-modulated risk model. North American Actuarial Journal, 11(2): 65–76 (2007)

Zhu, J., Yang, H. Ruin theory for a Markov regime-switching model under a threshold dividend strategy. Insurance: Mathematics and Economics, 42(1): 311–318 (2008)

Asmussen, S. Ruin Probabilities. World Scitific, Singapore, 2000

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported in part by the National Natural Science Foundation of China (No. 10971157) and the Ministry of Education of China.

Rights and permissions

About this article

Cite this article

Ma, Xm., Luo, K., Wang, Gm. et al. Constant barrier strategies in a two-state Markov-modulated dual risk model. Acta Math. Appl. Sin. Engl. Ser. 27, 679–690 (2011). https://doi.org/10.1007/s10255-011-0113-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10255-011-0113-7